Helping people reach their investment goals by providing a self servicing dashboard to manage and track their investments.

Product Designer

Team

01 Product Designer

01 Product Manager

06 Engineers

Deliverables

Design System

UI Component Library

High Fidelity Designs

Prototypes

Timeline

2022 - 2024

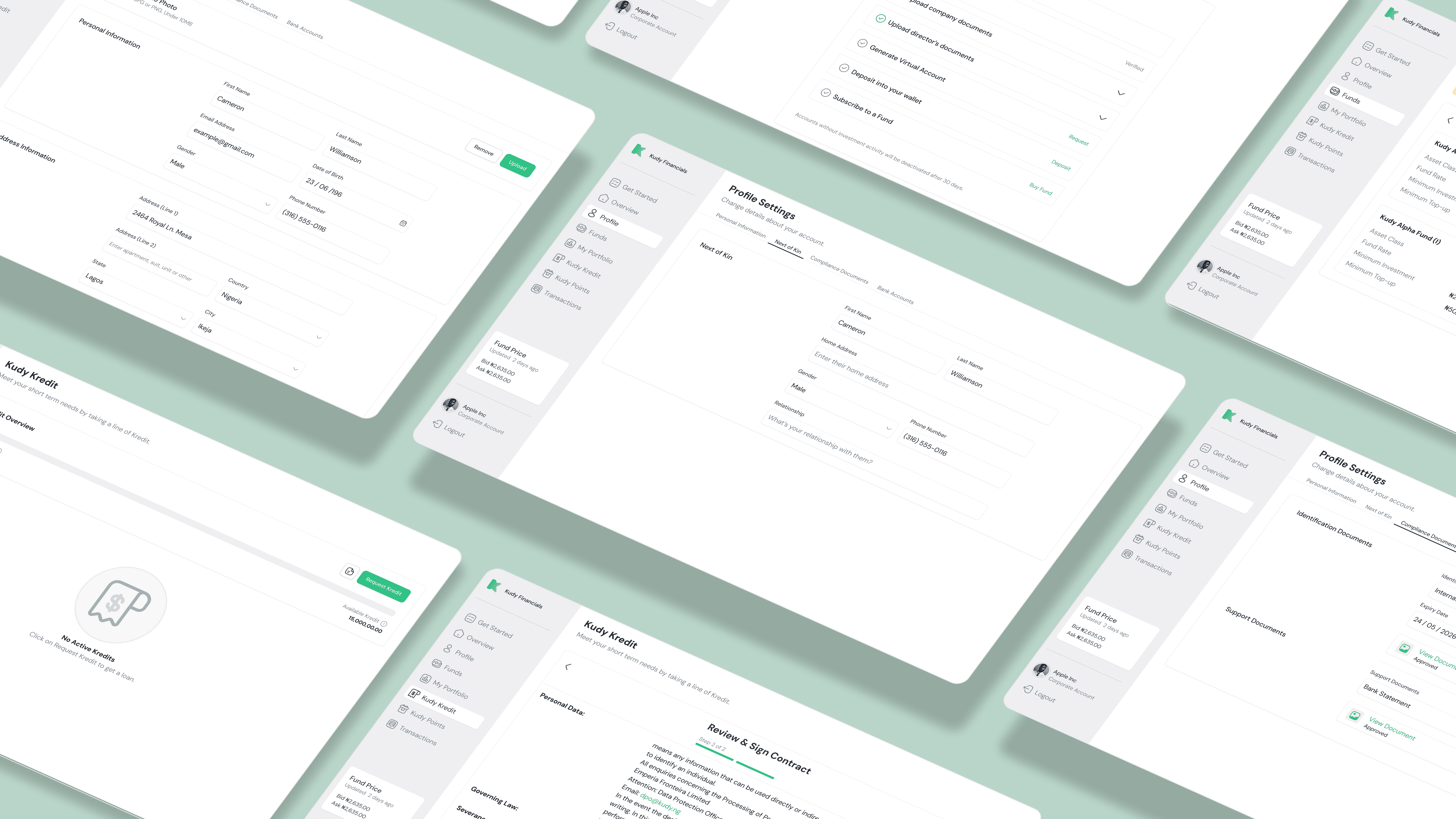

In late 2024, we shipped a new experience for Kudy's client management system called Fora. This experience cuts across both mobile and web platforms by addressing the regional needs of the various financial products and services offered by Kudy. I was responsible for Fora's design strategy, driving the project's visual identity and user experience. A design system was created to manage components, styles, grids, typography and other UI elements to ensure consistency across all platforms and improve design delivery.

These quality-of-life improvements have established Kudy as a reputable brand dedicated to elevating users' experience with wealth creation, ensuring that they thrive in their financial endeavours whilst safeguarding their funds.

Design Approach

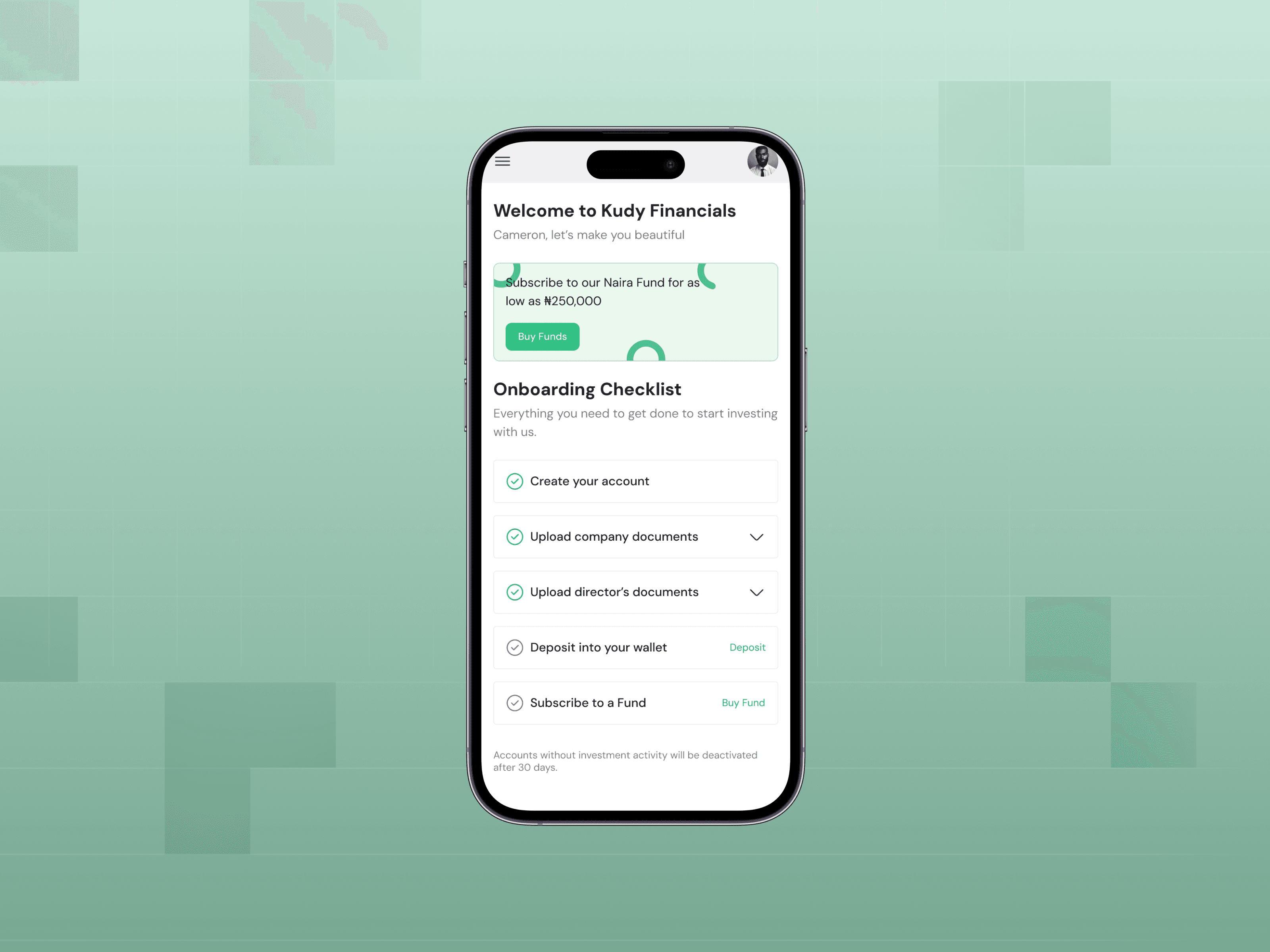

My design approach for this project focused on prioritising the core features, one of which was onboarding new clients through a self-service dashboard, eliminating the reliance on an account manager, create an automated system that enables clients to seamlessly buy and sell funds. With that in mind, my solution was to build a robust yet minimalist dashboard that delivers these functionalities effectively.

Kudy was rapidly growing from a private investment club to evolving into a leading global investment manager. This growth could only be achieved if a self-servicing dashboard that meets clients' needs is developed.

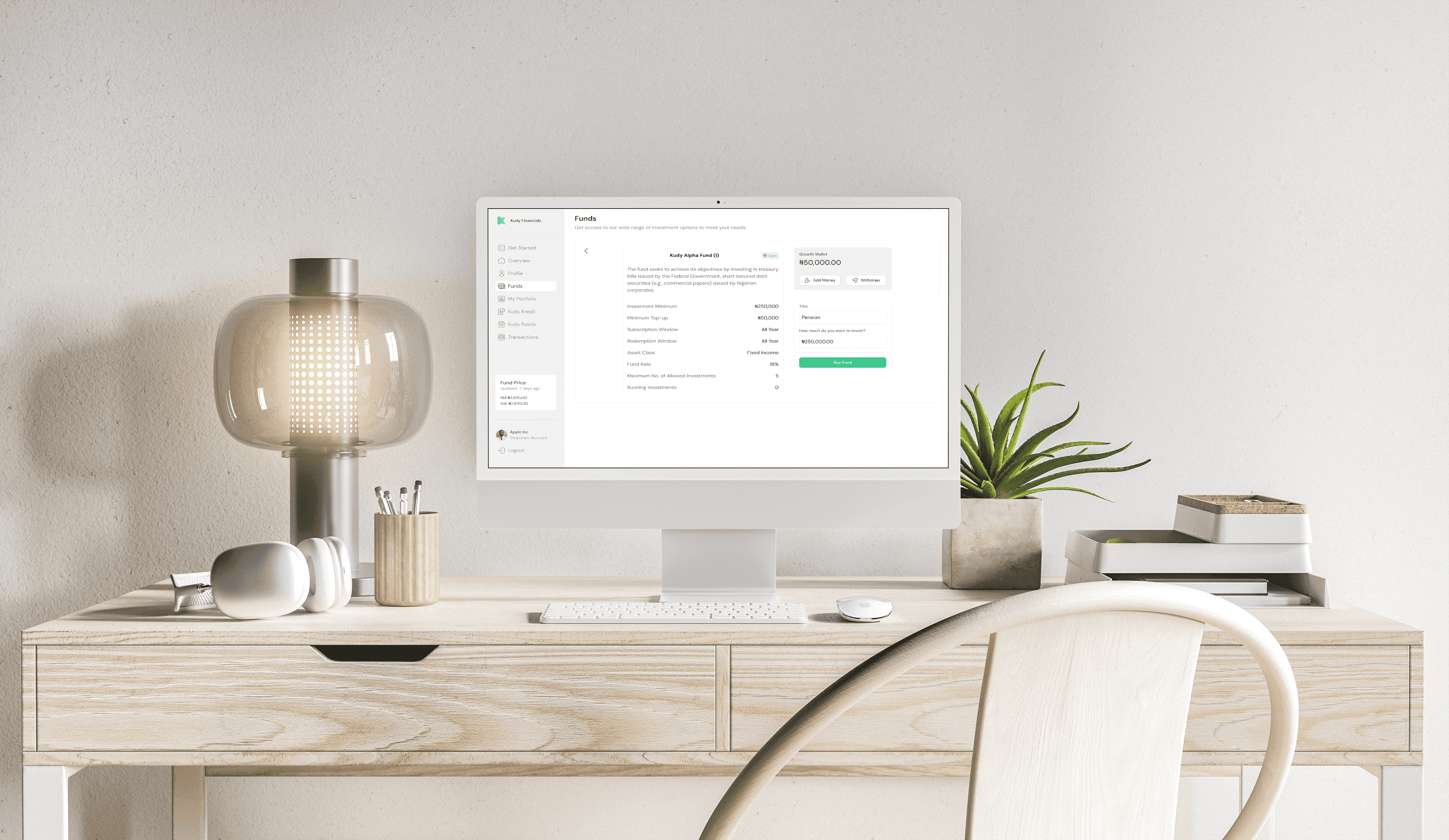

Empower Kudy's clients to have detailed information before buying a fund, enabling effortless fund subscriptions and sales, and providing easy activity and transaction tracking—all without relying on an account manager.

Research Summary

I conducted a competitive analysis of similar companies offering the same services. Specifically, I looked at PiggyVest and Cowrywise. I spent time analysing how they offer their products on their apps and features I might improve upon. There are three key problems that I identified

• No sufficient information about how Funds operate or comprehensive details about a Fund. This lack of clarity creates uncertainty and hinders clients from making well-informed decisions.

• Friction when depositing or withdrawing money. Users would typically interface with an account manager to carry out any transaction on their account.

• To support rapid growth a self-service dashboard is needed to remove response times allowing users to take actions on their accounts without a third party.

PROVIDE DETAILED INSIGHTS TO FUNDS

AUTOMATE ALL TRANSACTIONS

PROVIDE SELF SERVICE DASHBOARD

Designing The First Steps

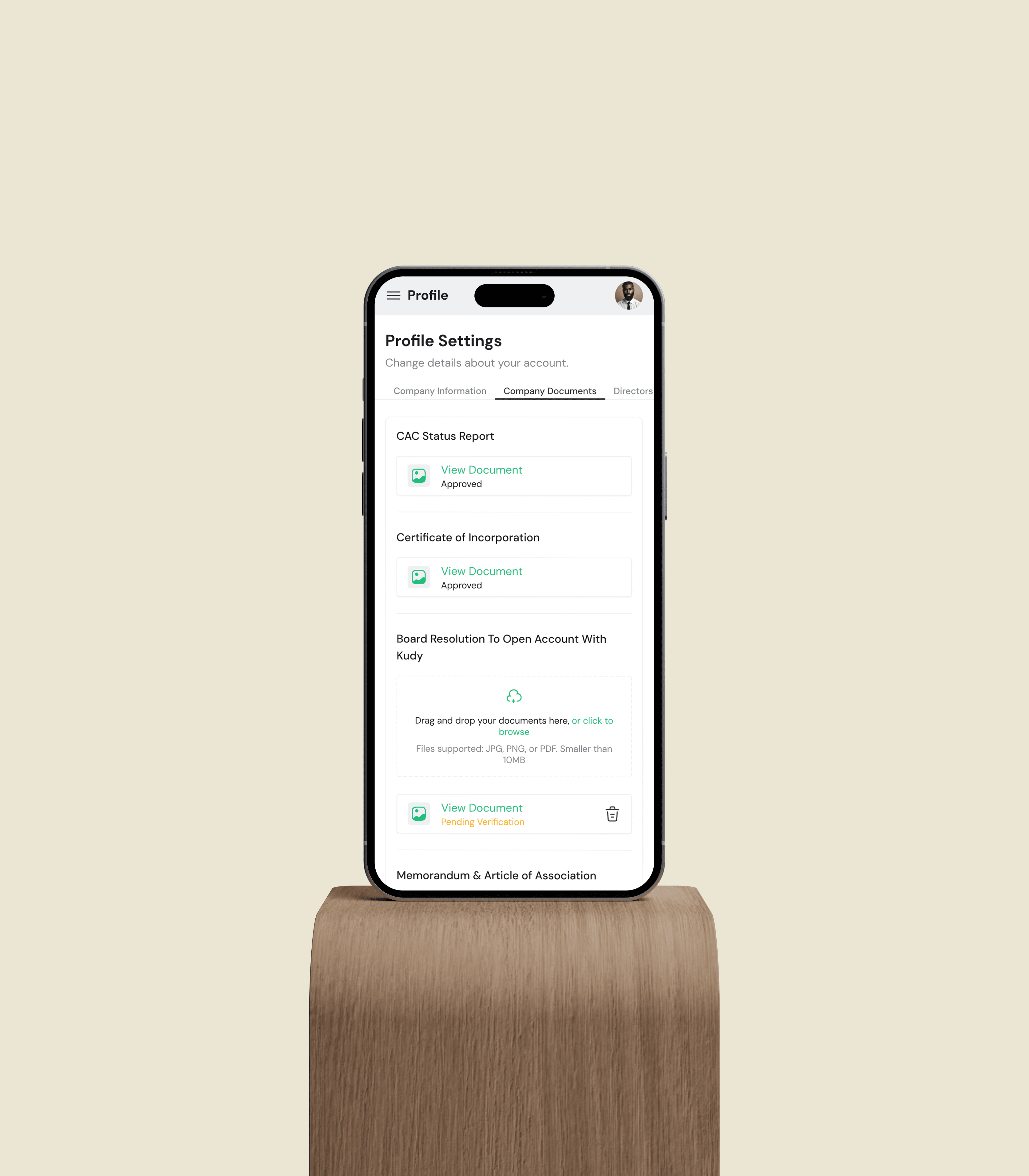

With all the feedback gathered, it was time to get my hands dirty. One critical requirement was ensuring clients could easily submit their documents and verify them to meet compliance regulations before taking action on the dashboard. I designed a document-upload flow for clients to collect all KYC documents and personal information. This solution streamlined the process, making it entirely self-service and significantly reducing the workload for support teams.

Key Metrics

2000+

CLIENTS HAVE SIGNED UP AND ACTIVELY USING THE DASHBOARD

$ MILLIONS

PROCESSED MILLIONS OF DOLLARS AND NAIRA IN FUND SUBSCRIPTION

25%

INCREASE IN CLIENTS SATISFACTION AND ENGAGEMENT

7%

INCREASE IN COMPANY REVENUE

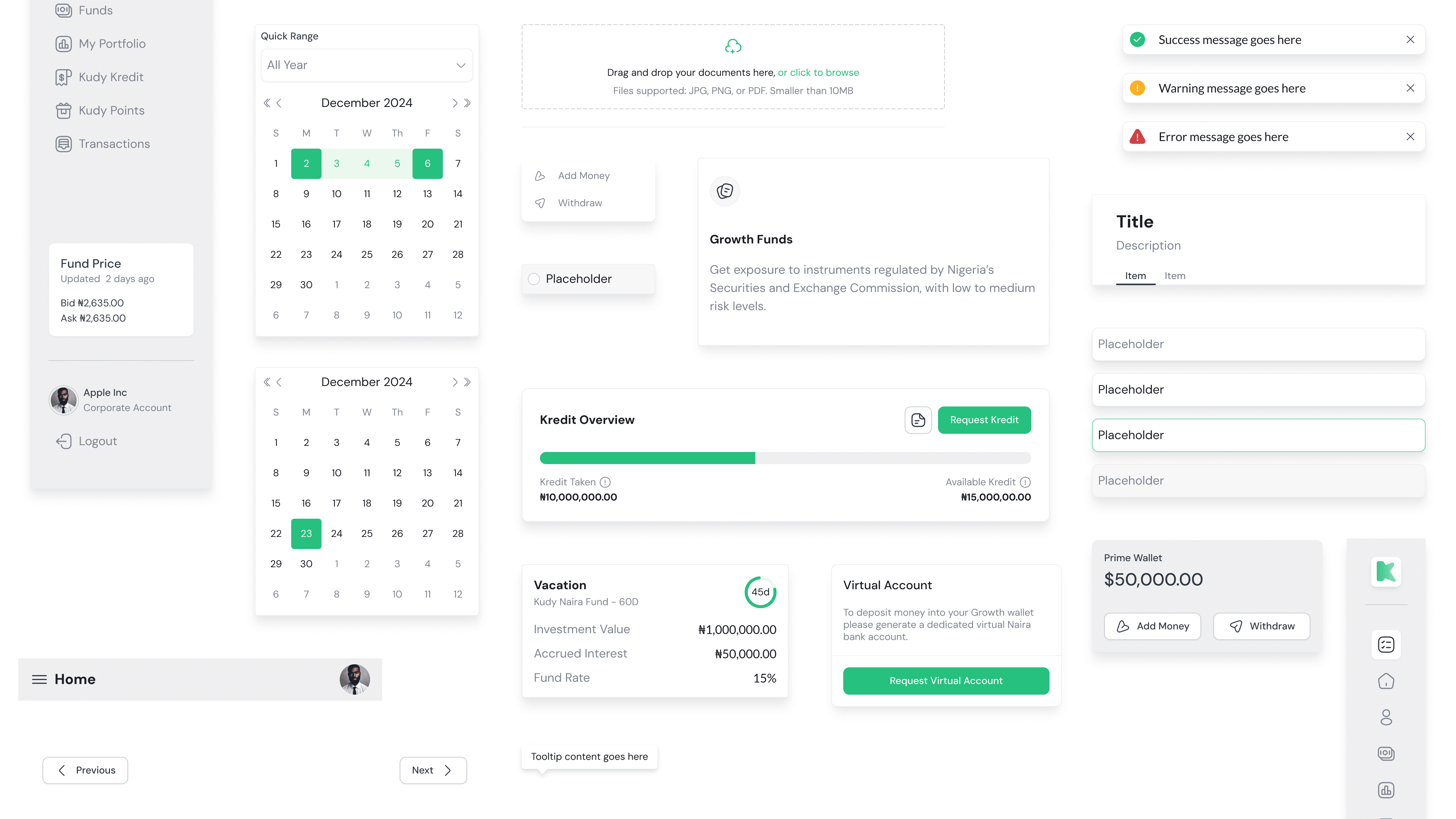

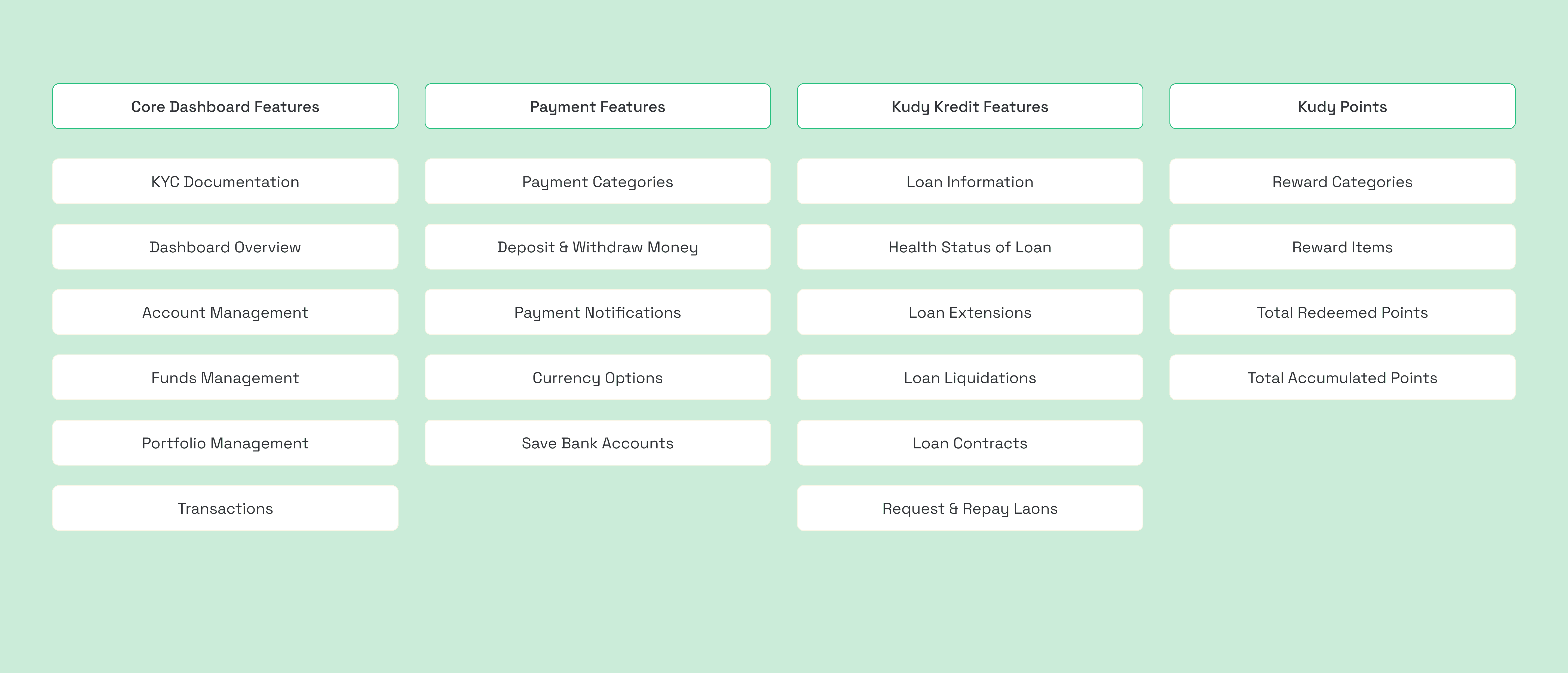

Fora's Design System

As I began to work on the UI elements and components I soon realised it would be cumbersome to manage and scale all the elements without a design system. So using the atomic design system framework I broke down the design to come up with a whole system consisting of grids, side navigation, colours, typography, segmented control, cards, and many other UI elements. This process significantly improved design delivery and implemtation.

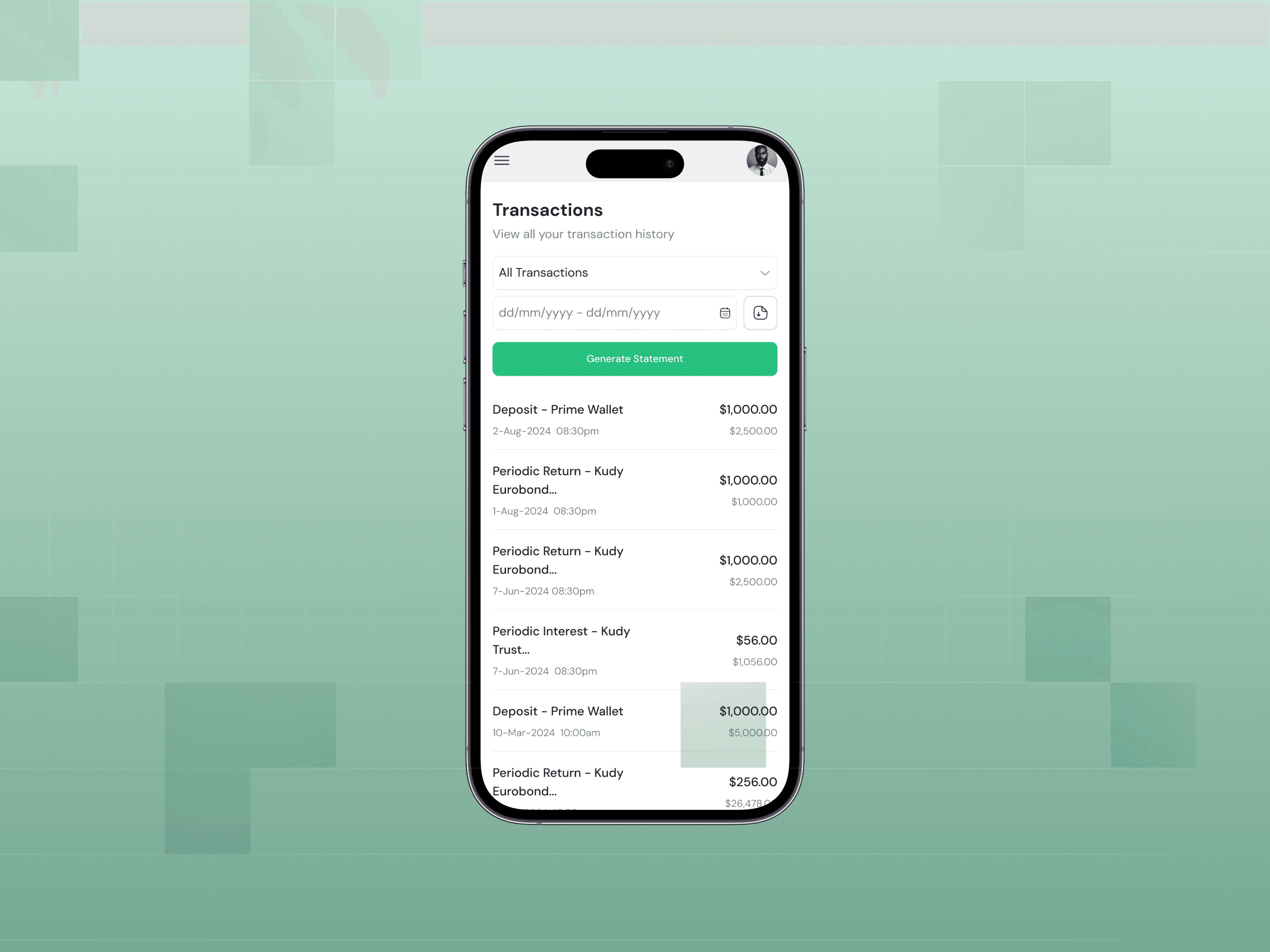

Final Outcome

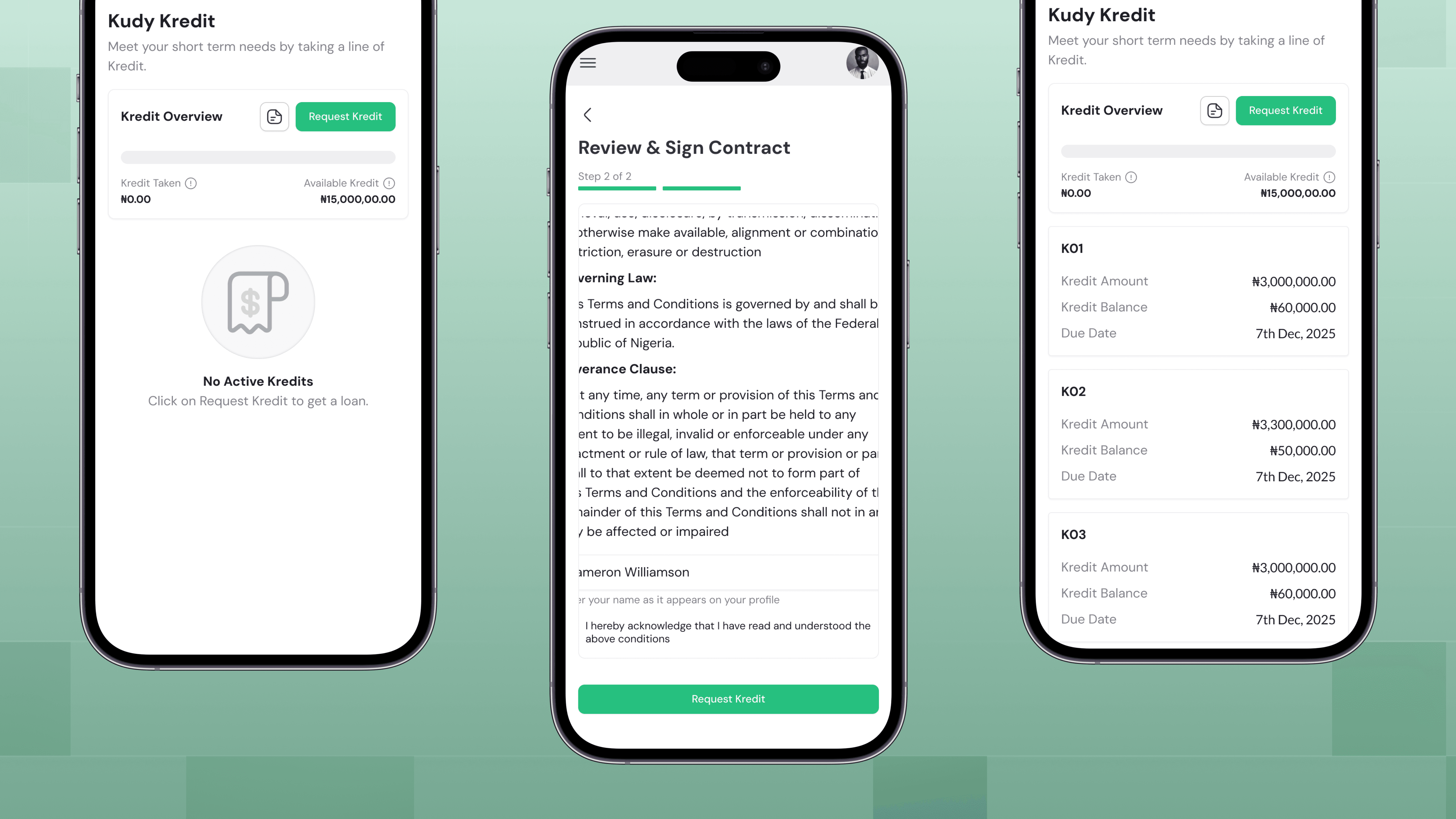

After successfully onboarding clients by uploading KYC documents and empowering them to buy and sell funds without an account manager, the dashboard matured into a more robust system with other key features like a referral system to award points and rewards to clients who refer other clients and a revenue-generating product called Kudy Kredit a feature that allows clients to take loans collateralized by their investment portfolio.

More Screens

Conclusion

Understanding the you are demographic building for. Because this project is targeted towards high networth individuals and corporate organizations it was difficult to meet all their needs as typically these sets of people are much older and tend to use technology lightly.

Building a design system. Having a design system for the project like this was crucial and I learned alot from building one from scratch, documenting what elements are and making it easy for anyone to pick up.

Trust. The backbone of any financial service is trust, people must feel safe when they use your platform. All design decisions have to be well thought out with this in mind.